The newly released “Islamic Finance and Renewable Energy” report, a collaboration between Greenpeace MENA, as part of the Ummah For Earth Alliance, and the Global Ethical Finance Initiative (GEFI), highlights the transformative potential of Islamic finance in accelerating the global transition to renewable energy. Findings from the report reveal that by allocating just 5% of the Islamic finance sector’s $4.5 trillion assets to renewable projects, $400 billion could be unlocked for climate Finance. The report was launched today during the “Unlocking Islamic Sustainable Finance Summit” organized by the Global Ethical Finance Initiative (GEFI).

The report underscores the alignment between Islamic finance principles—emphasising environmental stewardship, ethical investment, and social responsibility—and the urgent need for sustainable energy investment. With an annual renewable energy funding gap of $5.7 trillion, the Islamic finance sector is uniquely positioned to bridge this gap through Shariah-compliant financial instruments. These Islamic Financial instruments can potentially address the triple planetary crisis: climate change, pollution, and biodiversity loss.

“Islamic Finance is more than an economic tool; it is a powerful catalyst for renewable energy investment, driven by faith values and the principles of balance and stewardship. It helps ensure that investments actively contribute to solutions rather than exacerbating the existing crisis,” said Nouhad Awwad, Ummah For Earth’s Campaigner and Global Outreach Coordinator at Greenpeace MENA. “Mobilising Islamic finance assets, such as sukuk and zakat funds, can help triple renewable energy capacity by 2030 and pave the way for just transition, creating a future where no one is left behind.”

- The Islamic finance industry continues its robust expansion, with assets projected to reach $6.7 trillion by 2027. A strategic allocation of just 5% toward renewable energy and energy efficiency initiatives could mobilize approximately $400 billion for climate finance by 2030.

- The ESG sukuk market demonstrated unprecedented momentum in H1 2024, achieving $9.9 billion in issuances – equivalent to the entire 2023 total. Sustainability sukuk led this growth, comprising 63% of total ESG sukuk issuance.

- MENA region is leading this transition: UAE corporates issued a record $3.9 billion in ESG sukuk in 2023, while Saudi Arabia achieved over 300% increase in renewable capacity

- Islamic finance principles naturally align with environmental stewardship, climate action, and sustainable investment, attracting both Islamic and conventional investors to renewable projects.

- Countries like Indonesia (first sovereign green sukuk issuer) and Malaysia are pioneering frameworks combining Islamic finance with global sustainability standards

- Analysis of implemented projects funded through Green Sukuk reveals comprehensive socio-economic benefits including: job creation across renewable energy construction and operations; enhanced energy security through grid modernization and smart metering; technology transfer and innovation in sustainable infrastructure; improved public health outcomes through reduced emissions; and strengthened climate resilience for vulnerable communities.

Tariq Al-Olaimy, Islamic Finance Advisor to the Ummah For Earth Alliance, added, “Islamic finance represents more than an alternative financing approach—it’s a powerful solution for climate action. With Islamic finance assets projected to exceed $6.7 trillion by 2027, we have an unprecedented opportunity to align faith-based principles with environmental stewardship. Through strategic allocation of just 5% toward renewable energy, we could mobilize $400 billion by 2030 for climate solutions. The time for action is now—every investment decision we make today will impact generations to come. Islamic financial institutions must accelerate their commitment to renewable energy investments”.

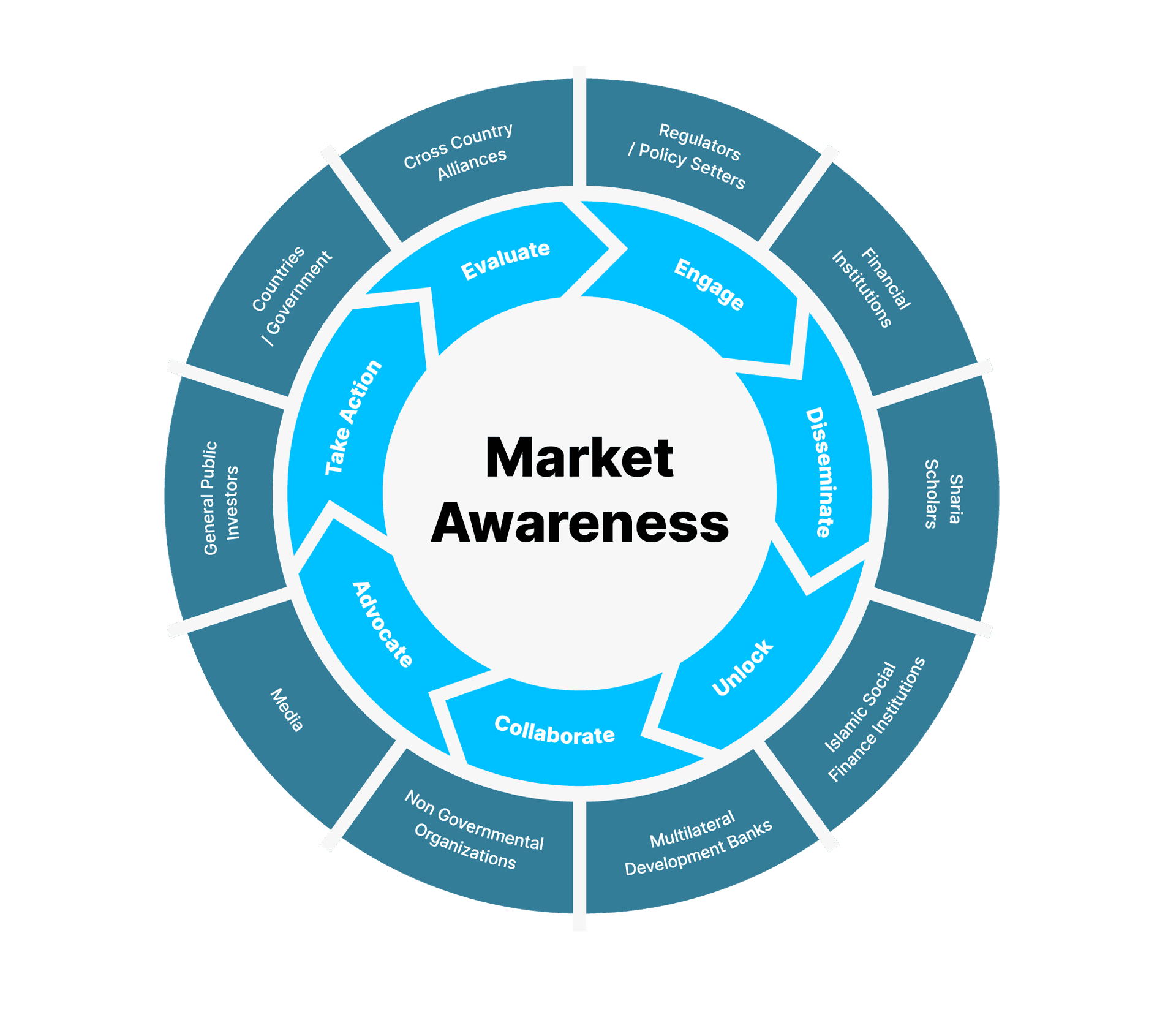

To facilitate this transition, the report also introduces the EDUCATE framework, which offers a practical blueprint for engaging stakeholders, fostering collaboration, and mobilising capital for sustainable energy projects.

Omar Shaikh, Managing Director of GEFI, commented, “Islamic finance stands on the brink of a transformative $1 trillion opportunity, aligning with the renewable sector’s financing needs. By adhering to Shariah principles, Islamic finance can drive decarbonisation and offer impactful solutions for a sustainable future, particularly in the Global South.”

To download the report, please click here.